We Publish Equity Research on Selected Public Companies

Think of us as the research team institutional investors rely on—except we work for retail investors like you, not hedge funds. Our First Principles Briefs deliver complete company analyses. Our Owner's Analysis reports extend into forensic depth when complexity demands it.

We publish equity research on public companies with cross-border complexity—primarily Singapore-listed businesses with Asia-Pacific exposure, and select US-listed companies operating across borders. Each analysis uses our proprietary Business Quality Scorecard, evaluating moat durability, management quality, and financial resilience. Our research concludes whether a business is worth owning outright, worth owning only under specific conditions, or worth avoiding entirely. Rigorous analysis means saying "no" as often as "yes."

You decide whether to invest and when. We provide the analytical foundation. The conviction is yours.

Start ReadingFeatured

The Hour Glass (AGS): The Owner's Analysis

Samudera Shipping Line Ltd. (S56): The Owner's Analysis

TAYLOR SWIFT: THE ECONOMICS OF OVER-SERVING

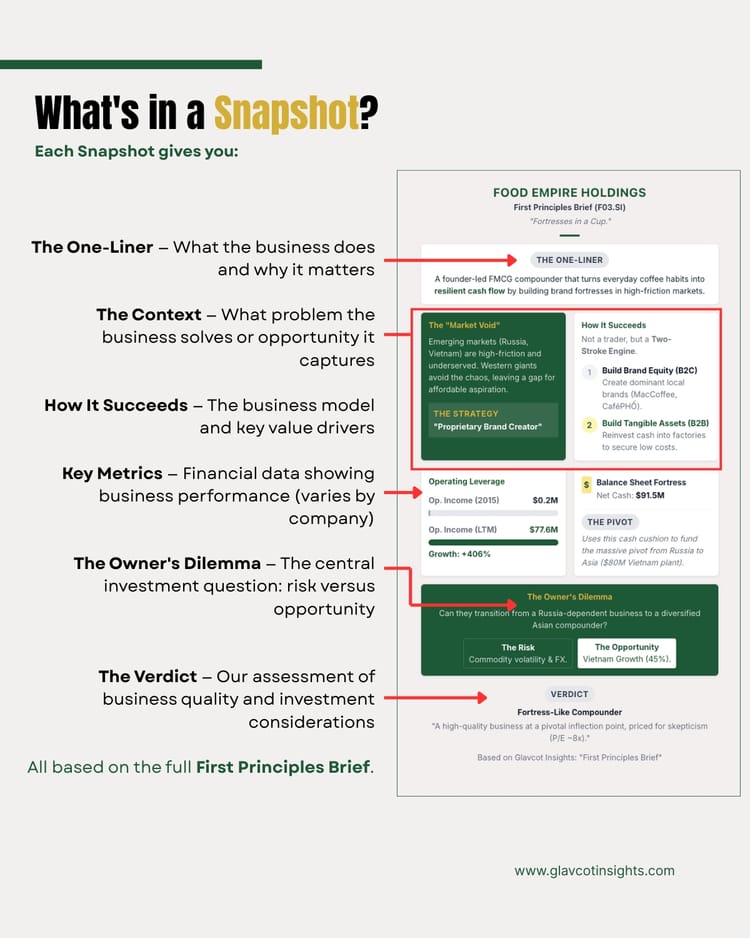

Company Snapshots: Quick Reference for Business Analysis

The Book Value Trap

What's Coming in 2026: The Owner's Analysis