The One-Liner

A family-owned gatekeeper to the world's most exclusive timepieces across Asia-Pacific — holding authorized dealer relationships with Swiss luxury brands that most retailers can't access, while navigating the post-pandemic recalibration in luxury watch demand with fortress financials and 45 years of proven resilience.

That's when I learned something counterintuitive about luxury watch retail: even if you had the money, you couldn't just walk in and walk out with your desired Rolex. Waitlists. Allocation systems. Relationship requirements. The scarcity wasn't accidental — it was the business model.

This triggered a question: How does a business make money when it deliberately restricts sales?

I thought about LVMH — the luxury empire built on brands like Louis Vuitton, Dior, and Tiffany — demonstrating that scarcity and exclusivity can be more profitable than volume. But LVMH owns the brands. The Hour Glass doesn't manufacture anything; it sells other people's products. Yet here it was, operating 70+ boutiques across Asia-Pacific for 45 years, surviving multiple financial crises, still standing.

I ran The Hour Glass through my investment rubric. The checkmarks surprised me: fortress balance sheet (net cash), consistent profitability, family ownership with long-term orientation, authorized dealer relationships with the world's most prestigious watch brands, strategic positioning in Asia-Pacific growth markets. The valuation seemed disconnected from the operational reality.

That disconnect deserved investigation.

The First Principles Brief

What is the Business?

The Hour Glass is Asia-Pacific's leading authorized retailer of ultra-luxury watches, operating 70+ boutiques across 15 cities in eight countries (Singapore, Malaysia, Thailand, Vietnam, Hong Kong, Japan, Australia, New Zealand). Founded in 1979 by Dr. Henry Tay and Dato' Dr. Jannie Tay, the company serves as the official retail partner for the world's most prestigious watch brands — Rolex, Patek Philippe, Audemars Piguet, Hublot, and 50+ others.

Unlike mass-market watch retailers, The Hour Glass operates in the ultra-luxury segment where relationships with Swiss watch manufacturers matter more than marketing budgets. The company's business model depends on two things: maintaining authorized dealer status with brands that control supply tightly, and cultivating long-term relationships with high-net-worth collectors who view timepieces as both art and investment.

The Hour Glass also owns a property portfolio ($64M+ in investment properties as of recent reports) concentrated in prime retail locations across Australia and Singapore, providing both operational stability and strategic flexibility.

Geographic Mix (H1 FY2025):

- Southeast Asia & Oceania: Primary revenue contributor (~60%+)

- Northeast Asia: Secondary market

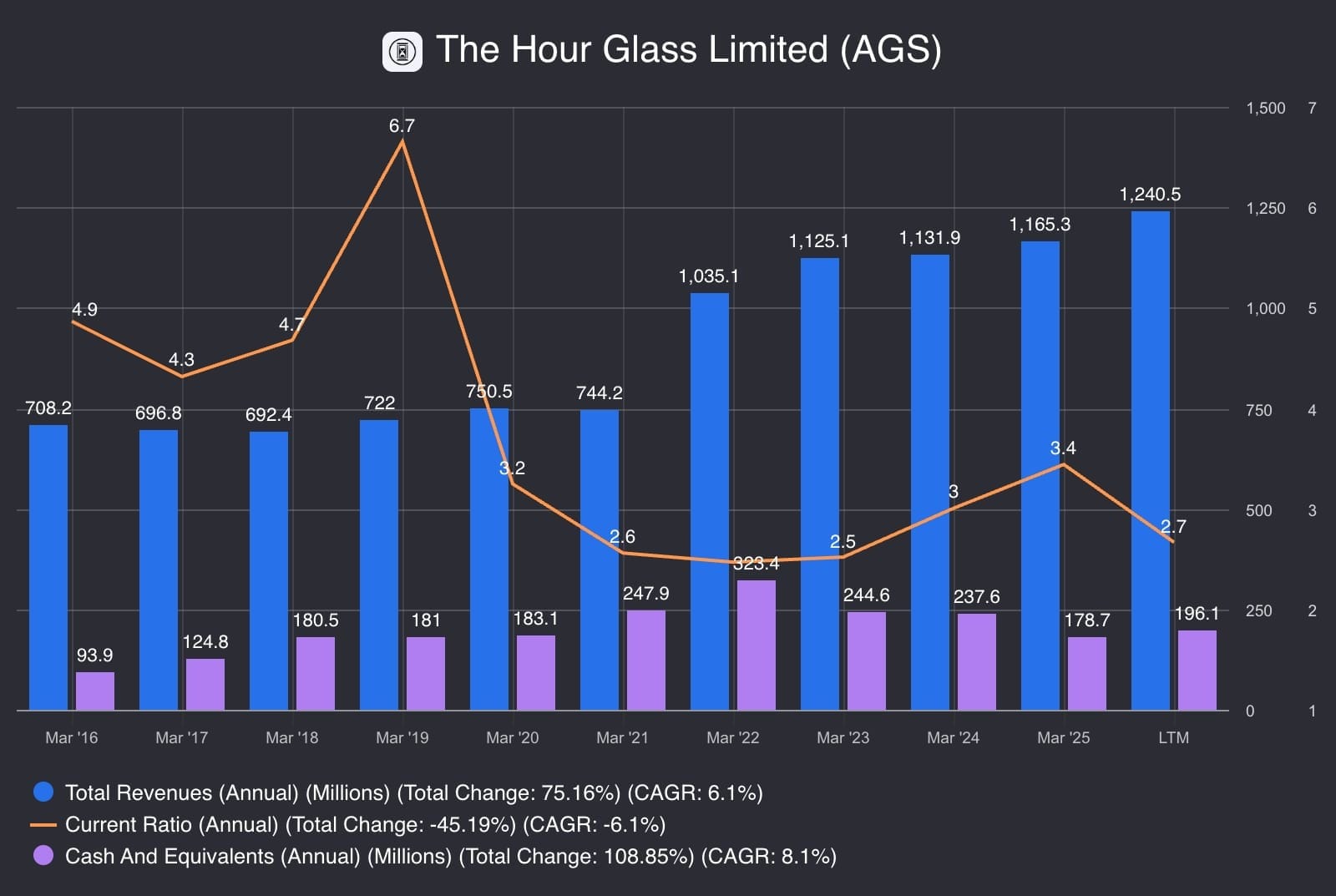

Revenue: S$1.16B (FY2025), S$1.13B (FY2024) | LTM Revenue (Q3 2025): S$1.24B | Market Cap: ~S$1.3B (as of late 2025)

Why Does the Business Exist?

The luxury watch industry has a distribution problem — and The Hour Glass is the solution.

Swiss watch manufacturers like Rolex, Patek Philippe, and Audemars Piguet produce some of the world's most coveted luxury goods, but they need trusted retail partners to maintain brand prestige while reaching wealthy consumers across Asia-Pacific. These brands can't afford to dilute exclusivity through mass distribution, yet they need market presence in the region's fastest-growing wealth centers.

The value The Hour Glass provides:

- Brand Stewardship - Luxury watch makers don't just want shelf space; they want retailers who understand their heritage, maintain premium retail environments, and cultivate the right clientele. A Patek Philippe boutique in Singapore's ION Orchard isn't just a store — it's brand theater.

- Market Access Without Risk - Swiss manufacturers avoid the capital intensity and operational complexity of owning retail networks across 15 cities in 8 countries. The Hour Glass absorbs the real estate costs, inventory financing, and staffing challenges while providing local market expertise.

- Client Curation - Ultra-luxury watches aren't sold; they're allocated. The Hour Glass maintains waitlists, builds relationships with collectors, and ensures limited-production pieces (Nautilus, Daytona, Royal Oak) reach genuine enthusiasts rather than speculators. This gatekeeping function matters to brands obsessed with preserving mystique.

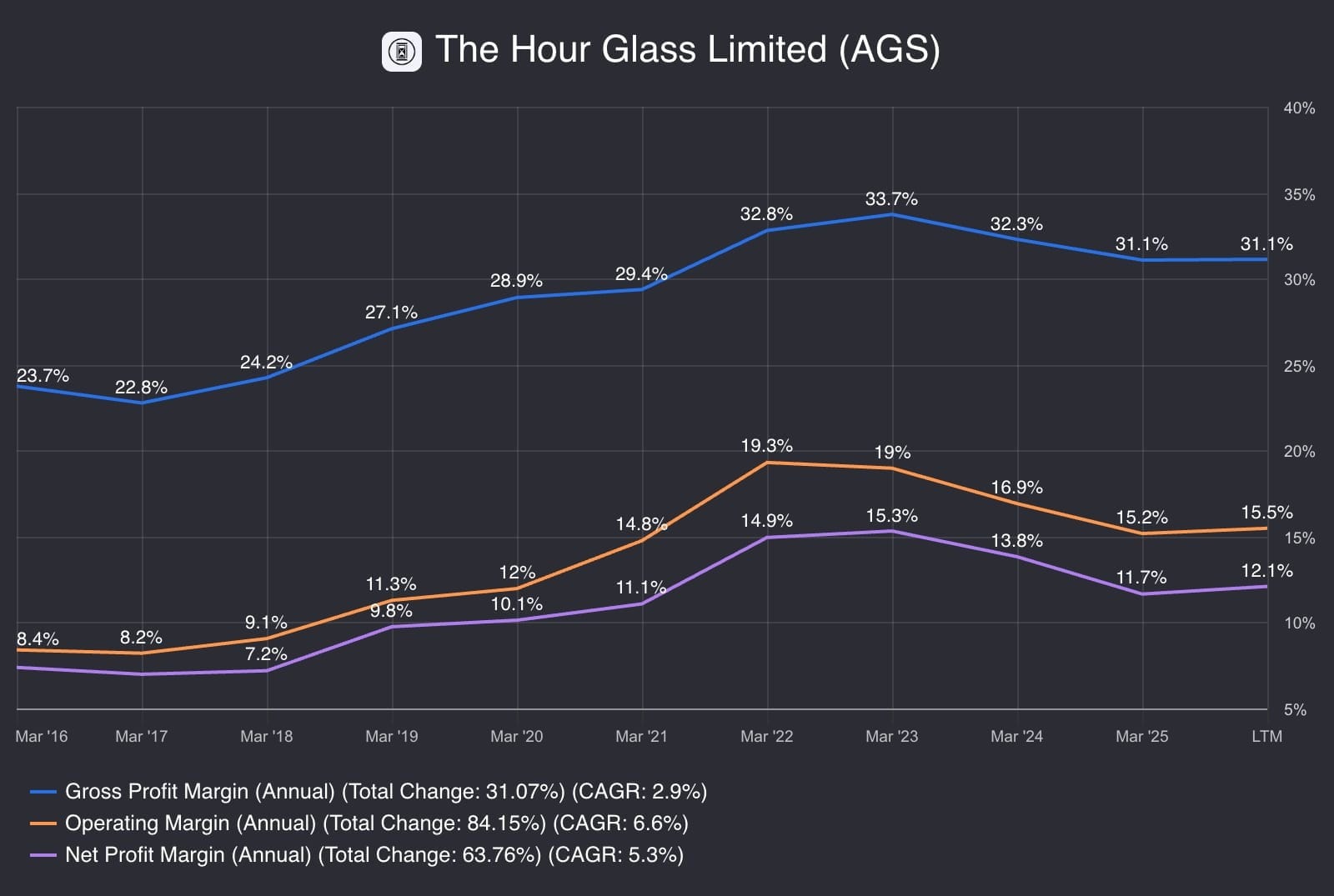

The economic logic: The Hour Glass captures 30-33% gross margins (the difference between wholesale cost from manufacturers and retail price) in exchange for bearing inventory risk, providing prime retail real estate, and maintaining the brand experience Swiss watchmakers demand but don't want to manage themselves.

For luxury to remain luxury, it must maintain exclusivity — a delicate balance of limited availability and psychological positioning. This phenomenon is known as The Veblen Effect: where higher prices increase a product's desirability rather than reducing demand, because consumers equate price with status, quality, and exclusivity. Swiss watch manufacturers operate at the intersection of authentic craftsmanship (some timepieces genuinely require years to produce in artisan ateliers) and strategic scarcity (production is deliberately constrained to preserve mystique). The price signals quality, but the unavailability amplifies desire.

This creates a distribution dilemma: brands need market presence in Asia-Pacific's growth centers, but mass distribution destroys the exclusivity that justifies premium pricing. The Hour Glass solves this by acting as a controlled gateway — providing selective access without diluting scarcity, maintaining the psychological effect where "if few can have it, everyone wants it."

How Does It Succeed?

The Hour Glass doesn't compete on price, marketing budgets, or product innovation — it wins through relationship capital and strategic positioning.

The Four Success Mechanics:

1. Exclusive Access = Competitive Advantage

Becoming an authorized Rolex or Patek Philippe dealer isn't a matter of writing a check. These brands vet partners rigorously, favoring retailers with:

- Multi-decade operating histories (The Hour Glass: 45 years)

- Family ownership signaling long-term commitment (Tay family: 56.4% ownership)

- Premium retail locations in key luxury corridors

- Track records of brand stewardship (not aggressive discounting or grey market leakage)

Once authorized, The Hour Glass gains access to inventory allocation, marketing co-op funds, and brand credibility that creates barriers for new entrants. A startup luxury watch retailer can't simply replicate this — it takes decades to earn Swiss brands' trust.

2. Geographic Positioning in Wealth Migration Paths

The Hour Glass planted flags early in markets where affluence is accelerating:

- Vietnam: 44.6% YoY revenue growth (H1 FY2025) as the country's upper-middle class expands

- Australia: Acquired exclusive Rolex distribution rights + premium retail properties before the luxury boom

- Thailand: Established presence in Bangkok and Phuket's high-end resort economy

This isn't just geographic diversification — it's strategic exposure to Asia-Pacific's wealth creation trajectory. While mature markets (Hong Kong, Singapore) face saturation, emerging markets provide growth runway.

3. Property Portfolio as Strategic Anchor

The Hour Glass owns S$64M+ in investment properties, concentrated in prime retail locations (Sydney's heritage-listed Pitt Street, Brisbane's luxury precinct). This creates two advantages:

- Cost Control: Owning vs. leasing flagship locations insulates from rent inflation in luxury corridors

- Balance Sheet Strength: Property values appreciate while generating rental income from non-watch retail tenants, providing financial stability during cyclical downturns

Think of it as insurance: if luxury watch demand collapses temporarily, the property portfolio continues generating cash flow.

4. Client Relationship Lock-In

Ultra-luxury watch retail isn't transactional — it's relational. A customer buying their first Rolex Submariner at age 35 might return for a Patek Philippe at 45, then a Richard Mille at 55. The Hour Glass cultivates these lifetime value relationships through:

- Allocation Power: Want a steel Rolex Daytona or Patek Nautilus? You need to be in the dealer's "book." The Hour Glass controls access.

- Service & Expertise: Sales consultants who understand complications, movements, and watch history provide value beyond order-taking.

- Community Building: "Advancing Watch Culture" positioning creates identity alignment with collectors who view watches as art, not accessories.

The Execution Discipline:

Success requires balancing competing forces:

- Maintain brand relationships (don't discount, don't oversupply grey market)

- Control inventory carefully (luxury watches tie up significant working capital)

- Expand selectively (new boutiques must meet brand standards and economic returns)

- Preserve financial conservatism (net cash position provides survival capacity during luxury downturns)

The Hour Glass has executed this playbook for 45 years — surviving the 1997 Asian Financial Crisis, 2008 GFC, and 2020 pandemic while competitors failed or consolidated.

Glavcot Business Scorecard

Pillar I: Business Quality (The Moat)

The Hour Glass doesn't manufacture watches — it sells other people's products. Yet it has survived and expanded for 45+ years in a business where authorized dealer relationships can be revoked at any time. That's the paradox worth understanding.

Three layers of competitive positioning:

- Authorized Dealer Gatekeeping

- Rolex, Patek Philippe, and Audemars Piguet don't sell to just anyone. Brand partners choose retailers carefully, favoring those with heritage, premium retail locations, and track records of brand stewardship. The Hour Glass's 45-year operating history and family ownership signal long-term commitment that Swiss brands value.

- Recent strategic wins: Expanded Rolex boutique presence in Australia through appointed partnerships — a significant vote of confidence from the world’s most influential luxury watch brand, also expanding mono-brand boutiques for Hublot and other prestige marques across Southeast Asia.

- Geographic Footprint in High-Growth Markets

- 70+ boutiques strategically positioned in the luxury retail corridors of Asia-Pacific's wealthiest cities. These locations aren't just stores — they're theaters for luxury consumption in regions (Vietnam, Thailand, Australia) where affluent consumers are still growing.

- The company pivoted early from mature markets (Singapore, Hong Kong) to emerging wealth centers (Vietnam saw 44.6% YoY growth in H1 FY2025).

- Client Relationships & Collector Networks

- Luxury watch retail is relationship-driven. Access to limited-production models (Patek Philippe Nautilus, Rolex Daytona) depends on dealer allocation. The Hour Glass maintains waitlists and cultivates collector relationships that competitors can't replicate overnight.

- The company's "watch culture" positioning (tagline: "Advancing Watch Culture") signals focus on connoisseurship over transactional sales.

The Vulnerability:

This is a relationship moat, not a structural moat. Brand partnerships can shift. Luxury demand is cyclical. The Hour Glass doesn't own the brands, doesn't control supply, and faces concentrated dependency on a handful of Swiss manufacturers.

Current Headwinds:

- Luxury watch industry experiencing post-pandemic normalization (H1 FY2025 revenue down 3% YoY before recovering; full FY2025 grew 2.9%)

- Interest registrations (customer demand signals) fell 8% YoY across key demographics

- Inventory levels reflating to pre-COVID norms as supply catches up to demand

- LTM trends (Q3 2025) show continued operational adjustments as industry recalibrates

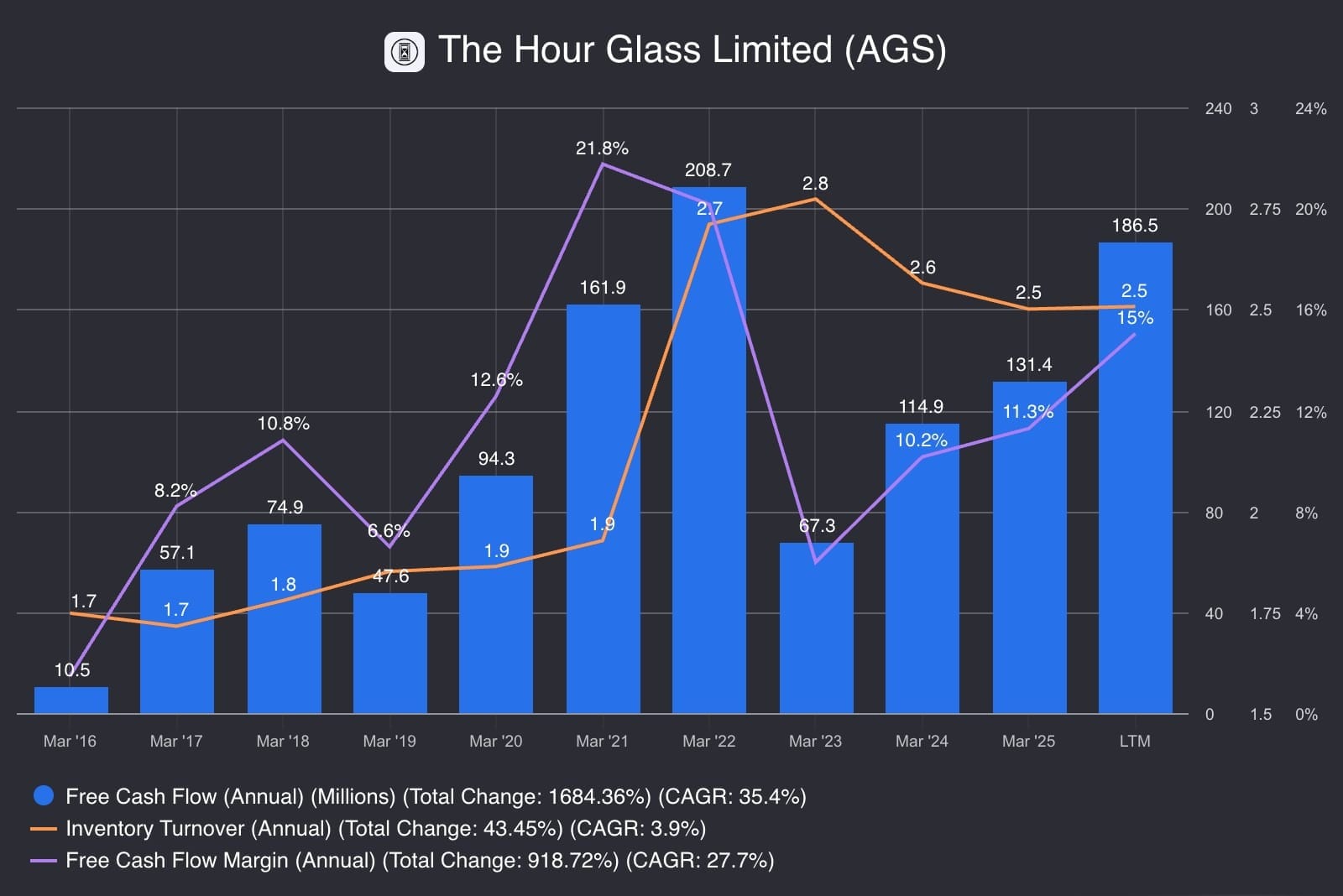

Operational Efficiency Check:

Despite the cyclical headwinds, The Hour Glass maintains solid operational fundamentals. Inventory moves at a healthy pace for luxury retail—not gathering dust, not being fire-sold. Cash generation stays strong even as profits compress, showing the business model converts earnings to cash reliably. The operational engine works.

The inventory turnover metric is crucial for luxury watch retail. Unlike fast fashion (10-12x turns), ultra-luxury timepieces naturally turn slower due to higher price points and collector-driven demand. The Hour Glass's stable 2.5x rate suggests efficient inventory management — watches aren't gathering dust, but they're not being fire-sold either.

Pillar II: Management Quality (The Stewards)

The Hour Glass is a second-generation family business — always a critical juncture. Founders Dr. Henry Tay (Executive Chairman) and Dato' Dr. Jannie Tay built the company from a single Lucky Plaza boutique in 1979. Their son, Michael Tay, has served as Group Managing Director since 2015, overseeing operations across all markets.

What the track record shows:

- 45 years of operational continuity (founded 1979, listed SGX 1988, graduated to Mainboard 1992) through multiple luxury cycles (1997 Asian Financial Crisis, 2008 Global Financial Crisis, 2020 COVID-19)

- Conservative capital allocation: Net cash position maintained consistently (S$237.6M cash vs. S$83.9M debt in FY2024), with debt tied exclusively to property holdings (not operational leverage)

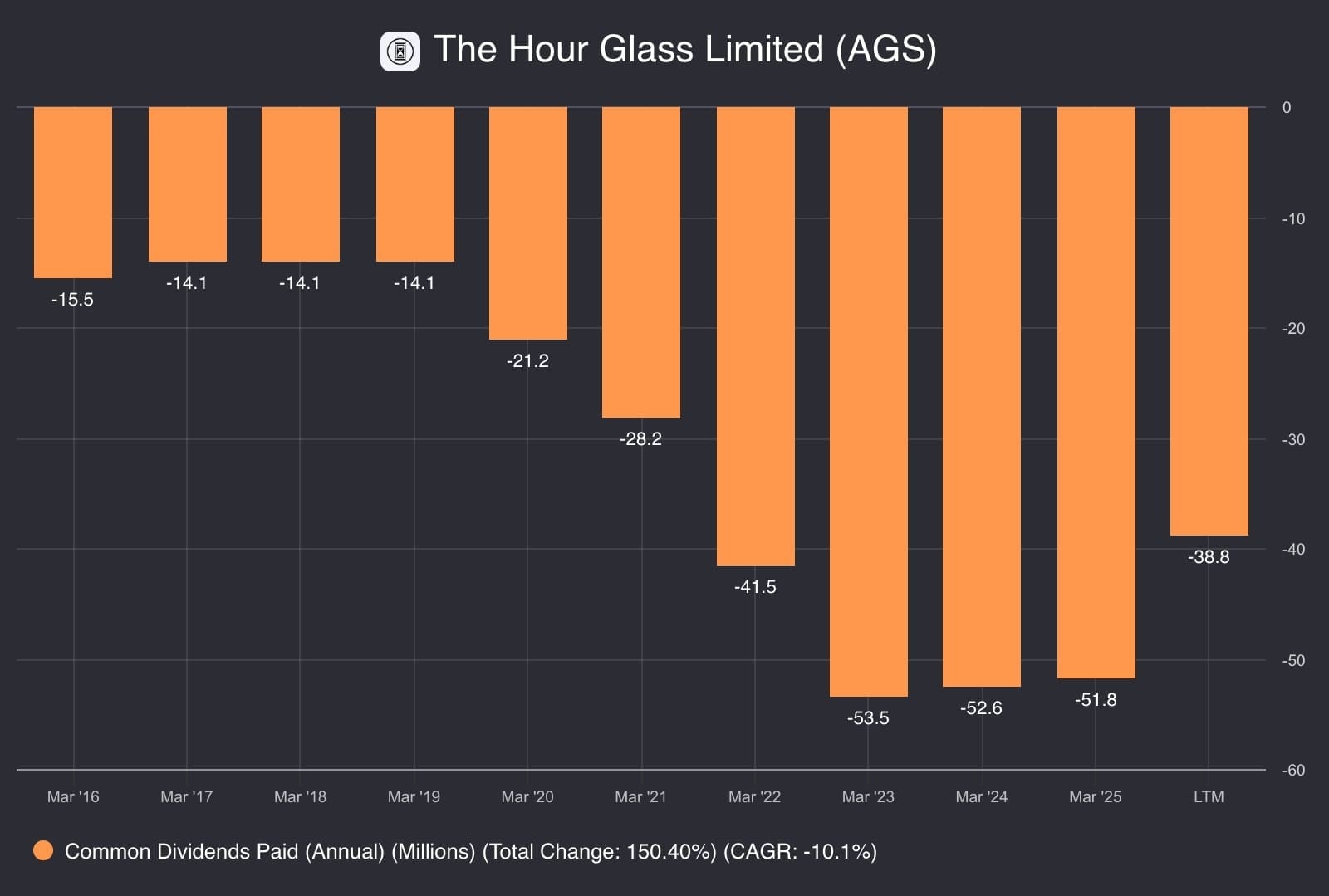

- Disciplined shareholder returns: S$14.7M in share buybacks (FY2024), steady dividends averaging 30-40% payout ratio

- Strategic geographic expansion: Acquisitions of Watches of Switzerland chain (Singapore, S$13.3M, 2014) and Australian premium retail properties (S$37.2M, 2015) positioned company ahead of regional wealth migration

Transparency & Governance:

SGX disclosure is adequate but not exemplary. The company provides geographic segment reporting and candid Chairman's letters that acknowledge industry challenges openly—rare honesty in luxury retail. Family dynamics carry the typical risks of second-generation transitions, with succession depth beyond the current generation remaining unclear.

Capital Allocation & Shareholder Returns:

The Hour Glass demonstrates consistent commitment to returning capital to shareholders. The dividend track record shows management balancing two priorities: rewarding shareholders during good times while preserving financial strength during downturns. The reduction from S$53.5M (2023) to S$38.8M (LTM) aligns with profit decline — pragmatic, not reckless.

Combined with the S$14.7M in buybacks, total shareholder returns (dividends + buybacks) totaled ~S$53M in FY2024, representing roughly one-third of net profit — a disciplined payout ratio that leaves room for reinvestment and balance sheet preservation.

Pillar III: Financial Health (The Engine)

The Hour Glass operates with fortress-level financial strength for a retailer, though recent performance shows the impact of luxury cycle normalization

Profitability & Margin Trends:

The margin story reveals normalizing profitability from pandemic-era peaks. Pricing power remains intact—the company isn't discounting to move inventory, preserving brand relationships. But operating costs are eating into profits as the business maintains market presence through the downturn. The compression shows a retailer choosing to invest in long-term positioning over short-term margins.

But what's driving margin compression?

Operating expenses grew faster than revenue (advertising, promotions, depreciation on new boutique buildouts). This is typical during luxury downturns — brands maintain market presence even as sales soften, protecting long-term positioning at the cost of near-term margins.

The 31% gross margin stability is notable — it suggests The Hour Glass isn't discounting to move inventory, preserving brand relationships and pricing discipline.

Revenue Growth & Liquidity Position:

The balance sheet shows consistent growth with financial flexibility. Revenue has compounded steadily over the decade, surviving multiple crises. Cash reserves remain stable through cycles, providing breathing room during downturns.

Current ratio context: The compression from 6.7x peak (2019) to 2.7x isn't distress — it's deployment. The company invested cash into inventory, boutique expansion, and property acquisitions during the growth phase. A 2.7x current ratio still indicates strong ability to meet short-term obligations (rule of thumb: >2.0x is healthy for retailers).

Balance Sheet Strength: Net cash position with debt tied exclusively to property holdings. Conservative structure — borrowings secured by investment properties, not operational leverage. The business funds growth from operations, not by stretching the balance sheet.

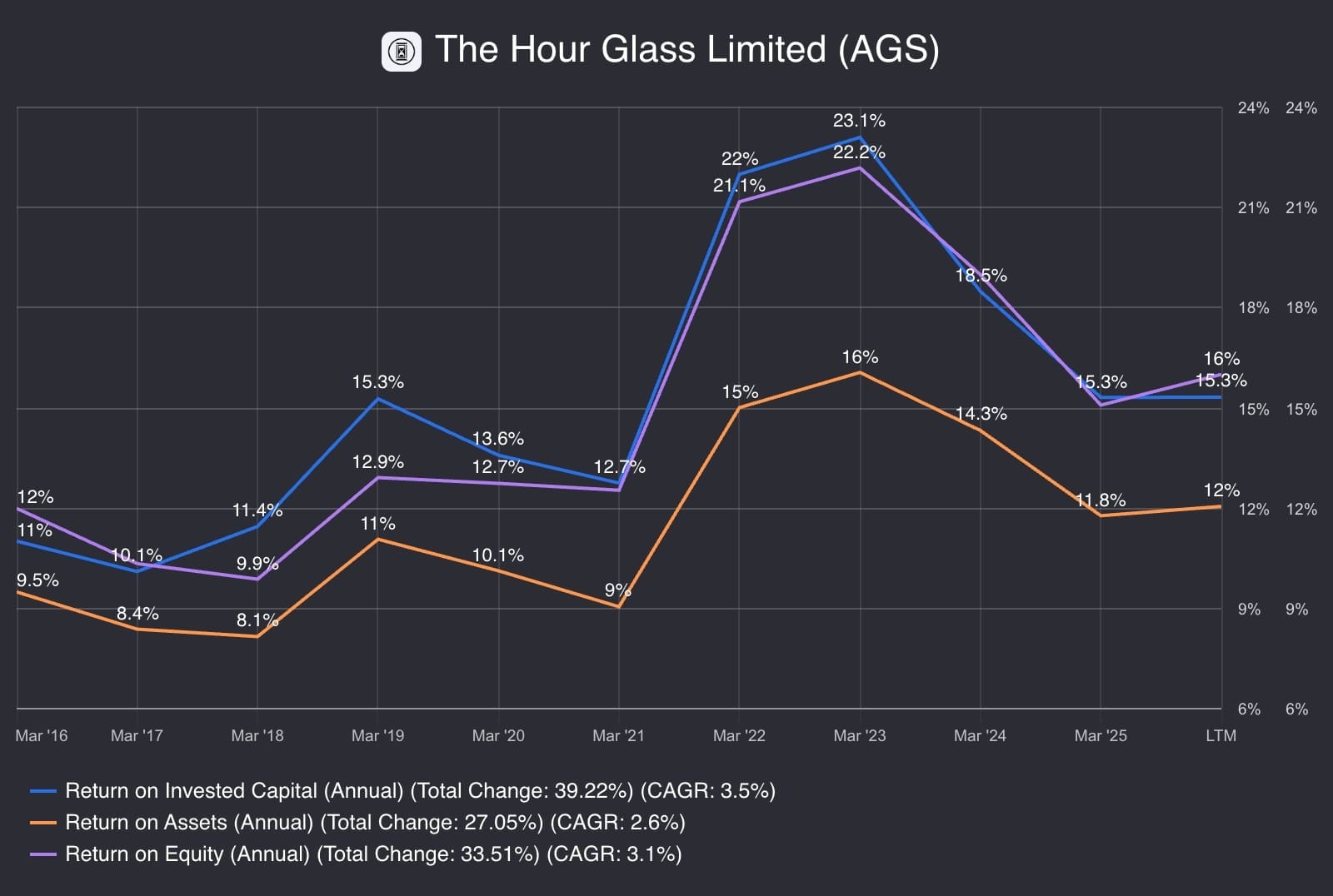

Return on Capital:

The returns tell the value creation story. The business generates above-average returns on deployed capital, even while moderating from pandemic peaks. The gap between returns earned and the cost of capital shows value creation continues — every dollar invested still produces excess returns.

The pandemic years (2022-2023) represented unsustainable peaks driven by suppressed luxury demand releasing post-lockdowns and limited Swiss supply. Current levels likely represent normalized, sustainable returns for this business — still respectable for a retailer.

Recent Performance Concerns:

- Revenue growth moderated: FY2024 +0.6%, FY2025 +2.9% (with H1 temporary decline before H2 recovery)

- Earnings pressure intensifying: H1 FY2025 profit down 21% YoY, full FY2025 down 13.6%

- LTM trends (September 2025) continue showing margin compression as operating expenses grow faster than revenue

- Industry normalizing from unsustainable pandemic-era peaks (2022-2023)

The Trade-off: Strong balance sheet (net cash, current ratio 2.7x, cash S$196M+ LTM) = survival capacity during luxury downturns. But declining margins + muted revenue growth = near-term earnings pressure. The company can weather storms but isn't immune to cyclical headwinds

Conclusion: The Owner's Dilemma

Here's what you need to wrestle with if you're considering The Hour Glass as a long-term holding: this is a family-owned luxury retailer with authorized access to the world's most exclusive watch brands and fortress financials, but it's navigating a critical post-pandemic recalibration in luxury demand.

The critical inflection point is Asia-Pacific growth—Southeast Asia's continued expansion and new boutique returns will cement the business as the region's dominant luxury watch gateway. Management has demonstrated discipline with cash and shareholder returns. The central challenge: sustaining profitability through the downturn without losing brand partnerships, and determining whether the profit squeeze represents temporary adjustment or permanent structural pressure. The market is pricing in skepticism at current valuations. Successful execution on Asia expansion with stabilizing profitability triggers a re-rating. Sustained luxury weakness combined with shifting brand partnerships exposes a moat that isn't deep enough to protect returns

The questions you should be asking yourself:

Can they maintain brand relationships through the downturn? Swiss manufacturers allocate inventory to partners they trust long-term. The Hour Glass's track record and family ownership signal stability. But if sales decline persists and competitors gain share, will brands shift allocation? The drop in customer interest registrations is an early warning sign.

Can management stay disciplined as the cycle turns? They've balanced reinvestment with shareholder returns well. But as profitability compresses, will they chase unprofitable growth or maintain fortress-building discipline? The property portfolio provides strategic flexibility, but also ties up capital.

Is the margin compression temporary or structural? Operating margins have fallen as expenses grew faster than revenue. Management attributes this to maintaining market presence during the downturn—advertising, new boutiques. But if luxury demand doesn't recover and these expenses become baseline, current margins become the new normal, not a trough.

Can you live with the ownership structure and liquidity constraints?

The Tay family controls ~53% of the company, leaving roughly 20-25% in public hands with average daily trading volumes of 71,000-105,000 shares. This creates two considerations: you’re a minority partner in a family-controlled business where the Tays drive strategic decisions, and exiting a meaningful position quickly may involve wider spreads or price impact. The family’s 45+ years of stewardship demonstrates long-term orientation and operational stability. But this structure requires patience—likely 5+ years for value realization—and position sizing that doesn’t depend on immediate liquidity. If your horizon and conviction match this structure, the lower liquidity becomes manageable friction rather than a dealbreaker.

The 3-5 year outlook for ultra-luxury timepieces faces structural headwinds beyond cyclical weakness. Younger generations increasingly value experiential luxury over possessions. Smartwatches (Apple Watch, Garmin) are commoditizing timekeeping functionality. Status signaling is shifting from physical goods to digital presence, sustainability credentials, and access to exclusive experiences. If mechanical watches transition from aspirational luxury to niche collector items—shrinking from broad affluent market to specialized enthusiasts—The Hour Glass's addressable market contracts permanently, not temporarily. The counter-argument: mechanical watches have survived quartz, smartphones, and social media shifts for decades, precisely because they're not about telling time—they're about craftsmanship, heritage, and tangible stores of value. But the question remains open: does the next generation of wealthy Asians covet a Rolex Daytona, or do they spend that $50,000 on crypto, experiences, or climate tech investments?

These are the critical unknowns. The encouraging signs—fortress balance sheet, authorized dealer status with prestige brands, decades of operating history, strategic positioning in Asia-Pacific growth markets—suggest a quality retailer at a cyclical low. The modest valuation reflects the market's skepticism.

Understanding these dynamics is essential before The Hour Glass belongs in your portfolio.

The stakes are clear, but the devil is in the details. Our comprehensive members-only analysis dissects the unit economics behind each business segment, maps out the competitive threats that could derail this turnaround, and reveals whether management's capital allocation track record justifies your trust. This is where conviction gets built—or where you discover the red flags hiding in plain sight.

References:

-

The Hour Glass Limited Annual Reports FY2020 - 2025 (Year ended 31 March 2020-2025)

-

GuruFocus - The Hour Glass Limited (SGX:AGS) Financial Data and Metrics

-

SimplyWall St - Hour Glass (SGX:AGS) Stock Analysis

-

Source: Company Filings (Data aggregated using Fiscal.ai) Last Twelve Months (LTM) data through Q3 2025 (September 2025)

-

SGX Filings - The Hour Glass Limited Corporate Announcements and Reports

-

The Hour Glass Official Website - Company Information and Boutique Locations (www.thehourglass.com)

-

Fortune Business Insights - Luxury Watch Market Size, Share & Trends Report (2024)

-

Grand View Research - Luxury Watch Market Size & Trends Analysis Report (2023-2030)

-

Market.us - Luxury Watch Market Analysis (2025)

-

Wikipedia - The Hour Glass (company) - Historical Background and Overview

-

National Library Singapore - Jannie Chan Biography and Business History

-

Note: Financial data charts display Last Twelve Months (LTM) data through September 2025. Where applicable, full fiscal year results (FY2025 ending March 31, 2025) are noted for context.

-

Yahoo Finance - The Hour Glass Limited (AGS.SI) Trading Statistics and Average Volume Data (December 2024-January 2025)

-

Disclosure: As of the date of publication, the author does not have a position in the following securities mentioned: The Hour Glass (AGS). The author has no plans to initiate or alter a position in any of the securities mentioned within 72 hours of publication.*

Glavcot Insights is now live. Join the free tier to get new research, updates, and future analysis directly in your inbox. (Check your spam folder if you don't see the confirmation email)