Understanding the Ownership Composition of Your Stocks (Part 2)

In Part 1, we established that ownership structure isn't a veto on investment decisions—it's critical context that shapes expectations and timelines.

We covered three foundational signals:

1. Who owns the majority (founders, strategic corporates, institutions)

2. Insider buying behavior (actions speak louder than words)

3. Public Ownership composition (low, medium, or high—each with trade-offs)

Now we'll explore two additional signals and see how these dynamics play out across different companies.

A Mental Model: Ownership as a Rowing Crew

Think of ownership structure as a rowing crew heading toward a destination.

Low public ownership (<25%) is like a "tight-crew" boat. Generally, every crew knows the course, the rhythm is set, and they're rowing in perfect sync. As a passenger, you're along for the ride—but you have no oar and no vote on direction or pace. If the crew is skilled and the destination sound, you'll get there efficiently. But you're entirely dependent on their judgment, timeline, and willingness to keep rowing.

Medium public ownership (25-40%) is a larger boat where the founding crew still holds most oars, but they've brought on additional rowers. There's clear direction from those who built the boat, but the added hands mean more power when everyone pulls together—and more friction when they don't. You have an oar now, and some voice in the effort, but the original crew still controls navigation.

High public ownership (>40%) resembles a vessel with dozens of rowers, many who showed up at the dock that morning. No single group controls the rhythm. When conditions are favorable, coordinated effort moves the boat fast. But when uncertainty hits, rowers panic and jump overboard—the boat lists, progress stalls, even though the destination hasn't changed. Speed comes from coordination, but volatility comes from crowd behavior that may have nothing to do with the journey itself.

Understanding this helps you calibrate expectations: patient capital works in a racing shell with an experienced crew, but requires different risk tolerance than boarding a crowded vessel where half the rowers might bail at the first headwind.

KEY SIGNALS TO EVALUATE

SIGNAL 4: IS PUBLIC OWNERSHIP INCREASING OR DECREASING?

Tracking this over several years provides context.

Public Ownership increasing: Insiders are distributing shares to public markets. This can signal preparation for broader institutional access, confidence that market will value the company fairly, or maturing from private to truly public entity.

Public Ownership decreasing: Insiders are consolidating control. This can signal belief shares are undervalued (positive if buying back), preparation to take company private, or reduced commitment to public shareholders (negative if just concentrating control).

Context matters: Decreasing float via buybacks when undervalued shows conviction. Decreasing float via insider accumulation at low prices without clear benefit to other shareholders raises questions.

SIGNAL 5: HOW DO MAJOR HOLDERS BEHAVE DURING STRESS?

This reveals true alignment.

During market downturns or business challenges:

- Do insiders buy more? Strong signal of conviction

- Do they hold steady? Neutral to positive

- Do they sell? Concerning

During strong performance:

- Do they distribute gains via dividends? Shareholder-friendly

- Do they extract via related-party transactions? Red flag

- Do they reinvest in growth? Good if returns justify it

The pattern over time matters more than single transactions.

DEEPER CASE STUDIES

The Hour Glass: Quality Business, Structural Constraints

Public ownership is relatively low, with the Tay family controlling the company through private vehicles.

Reading the signals:

The family has a 45+ year track record of stewardship in luxury watch retail.1 Despite boom periods in the luxury market, they haven't sold their holdings—showing long-term conviction. The company was founded in 1979 by Dr. Henry Tay and Jannie Chan, building on the family's involvement in watch merchandising since the 1940s. But minority shareholders essentially follow family decisions.

The implication: Quality business with Asian wealth tailwinds and strong brand relationships (Rolex partnership since founding), but the structure creates constraints. Price movements can lag business performance significantly. This structure may appeal to investors who anticipate the family will eventually monetize through subsidiary listings, mergers, or full exit—or who value dividend yield despite the lower liquidity and extended timeline for potential value realization.

Requires exceptional patience or visible catalyst.

DBS Bank: The Institutional Standard

The bank has substantial public shares with a diversified ownership base. Temasek provides anchor stability while maintaining strong governance standards. Daily trading volumes support institutional participation.

Reading the signals:

This is optimal structure for price discovery. The ownership composition enables efficient pricing and institutional accessibility without concentration risk.

The implication: You're evaluating a high-quality business at market-determined prices. No hidden structural discount, no complexity—just fundamentals versus valuation. The ownership structure supports transparent, efficient pricing.

Price typically reflects market consensus. Upside comes from execution and industry dynamics, not from ownership structure inefficiencies.

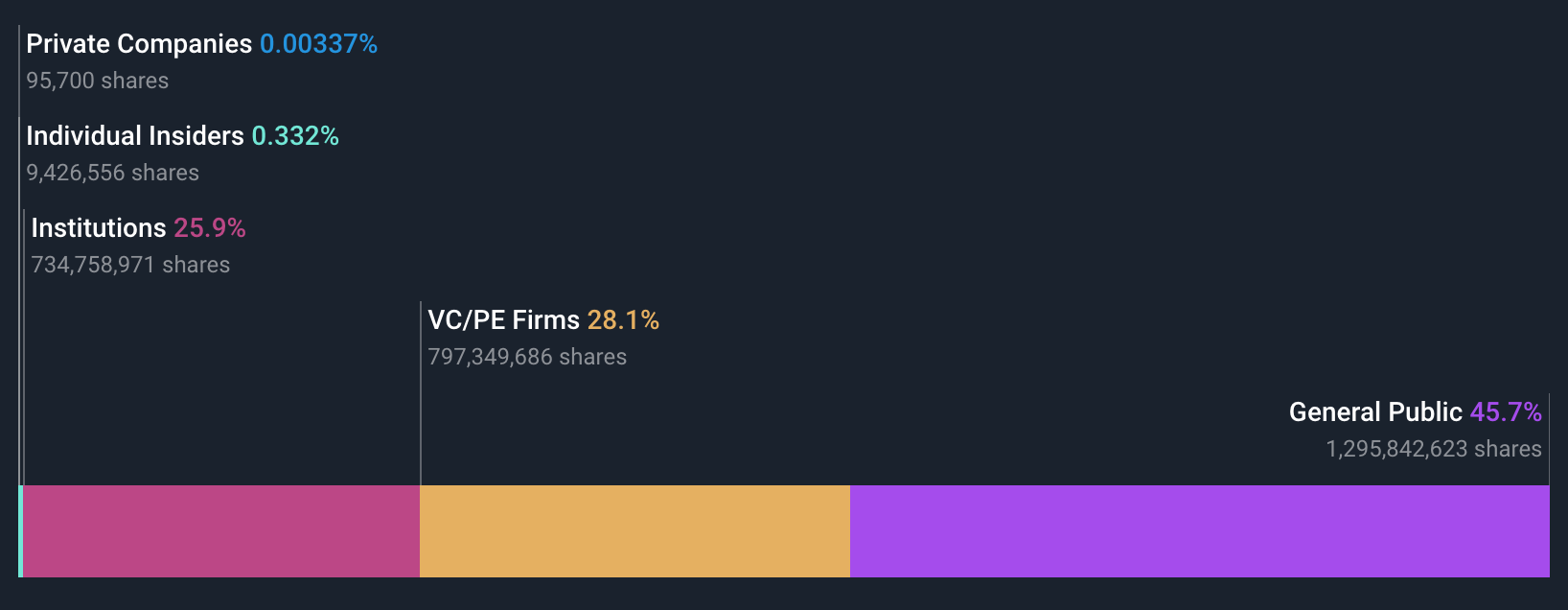

NVIDIA: The Double-Edged Sword of Institutional Concentration

The company has relatively modest direct public ownership, but institutional ownership comprises around 68% of shares.2

Reading the signals:

The business has grown dramatically alongside the adoption of AI technologies and accelerated computing. As institutions recognized this opportunity, they built substantial positions. Public enthusiasm for AI-related stocks added momentum.

The implication: When institutions collectively hold such a large portion, their actions can significantly impact share price regardless of quarterly business performance. At certain points, these large institutional holders may need to rebalance portfolios, raise cash for redemptions, or simply take profits after strong runs.

This means you might see meaningful share price declines even when NVIDIA's business performance remains strong. The price movement reflects institutional portfolio decisions—not necessarily the company doing poorly. This connects back to the principle: share price movements don't always mean the business itself has changed.

The ownership composition creates a dynamic where price can move substantially based on factors other than the company's operational reality.

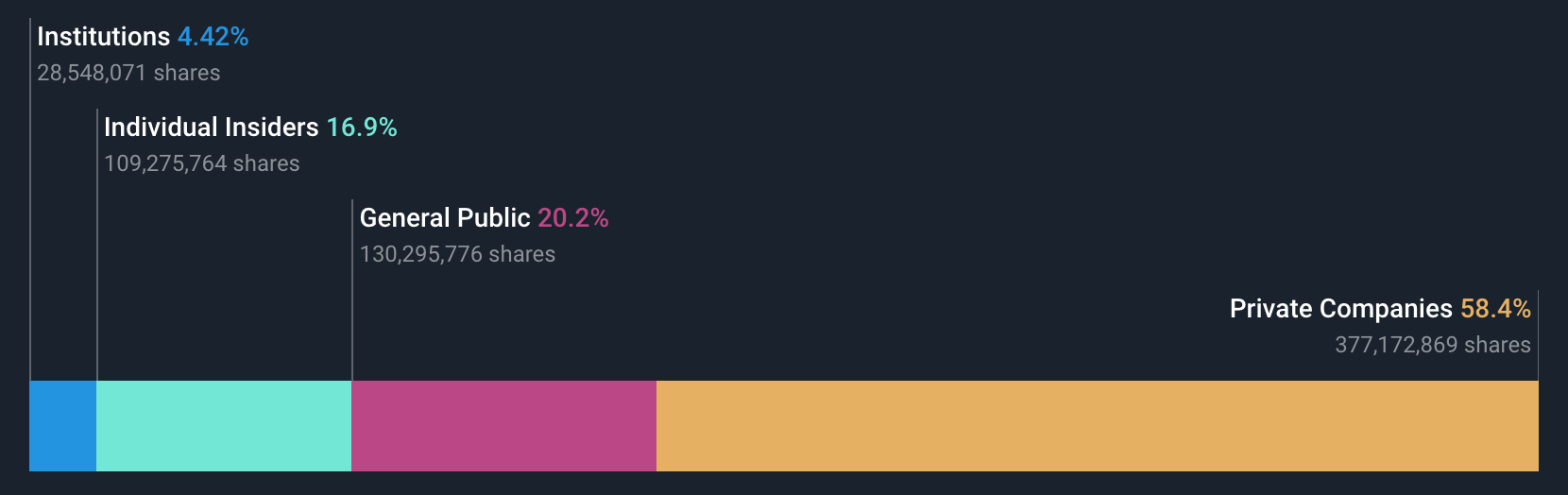

Samudera Shipping: Parent-Subsidiary Dynamics

Public ownership is modest, with the Indonesian parent company controlling the majority.

Reading the signals:

The parent has strategic interest in Indonesian logistics infrastructure. They're not exiting. But this functions more like a subsidiary than an independent public company.

The implication:

This structure presents considerations around both shipping sector cyclicality and parent-subsidiary dynamics that require careful evaluation. The parent provides stability—they won't sell during recovery periods—but understanding their capital allocation priorities and related-party transaction history becomes essential context.

PUTTING IT TOGETHER

It provides context for interpreting how business performance may translate to share price movements—including the timeline, potential catalysts, and market dynamics at play.

Medium public ownership with strong insider ownership and buyback activity: This structure often features aligned incentives between controlling shareholders and minority investors. When insiders hold substantial stakes and actively buy back shares, it signals confidence in value. The concentrated ownership can amplify price movements when catalysts occur, though the timeline for value recognition may extend over several years.

Very low public ownership with no insider buying and no dividends: This structure suggests controlling shareholders may prioritize factors other than share price appreciation. Without visible catalysts or income generation, share price movements may remain muted regardless of business performance. The opportunity cost consideration becomes relevant for capital deployed here versus alternatives.

High public ownership with diversified institutional ownership: This structure typically features relatively efficient price discovery, with share prices responding more quickly to business developments. The institutional presence provides liquidity and active trading, though prices reflect broad market consensus rather than structural inefficiencies.

High institutional concentration: This structure validates institutional interest in the business thesis, though share price movements can reflect institutional portfolio decisions (rebalancing, redemptions, sector rotation) as much as company-specific fundamentals. Even operationally sound businesses may experience significant price movements driven by institutional flows rather than operational changes.3

THE CORE PRINCIPLES

2. Ownership as context: After confirming quality, evaluate structure to understand the dynamics you're entering

3. Insider actions reveal conviction: Share purchases, buybacks, and dividends provide behavioral signals beyond stated intentions

4. Structure shapes dynamics: Concentrated ownership often correlates with extended timelines for value recognition; dispersed ownership features different market dynamics

5. No structure is inherently superior: Each has trade-offs; understanding them is what matters

CONCLUSION: Know the Game You're Playing

When I realized those "undervalued" companies with very low public ownership were just controlling shareholders trading amongst themselves, I stopped asking "Why is this cheap?"

I started asking: "Do the controlling shareholders want to surface value, or are they content with the status quo?"

If they're buying shares, implementing buybacks, and growing the business—they want to surface value. That's when concentrated ownership becomes an opportunity to ride along.

If they're extracting via salaries, conducting related-party deals, and ignoring share price—they're comfortable with things as they are. That's when low ownership becomes a trap.

The ownership composition reveals the game being played.

Understanding these dynamics completes the analytical picture.

⚡In January 2026, I'll be publishing The Owner's Analysis of Samudera Shipping—a comprehensive deep-dive that applies this ownership framework alongside full business evaluation, financial analysis, and valuation using the Glavcot Business Quality Scorecard.

Unlike the flagship analyses of Grab Holdings and Food Empire (which remain freely accessible), future Owner's Analyses including Samudera will be available exclusively to Glavcot Insights members as we transition to our two-tier research model.

The First Principles Brief for Samudera is already available in the Insight Library. Members gain access to the complete Owner's Analysis with detailed scorecards, valuations, and investment thesis in January.

References

2. NVIDIA Corporation's institutional ownership is approximately 68% as of recent filings. Source: Multiple sources including Eqvista (October 2025), fintel.io, and MacroAxis equity ownership data. ↩︎

3. Studies on institutional trading demonstrate that portfolio rebalancing and liquidity management can create price pressure independent of fundamental business performance. Source: "Resolving the Rebalancing Riddle for Institutional Clients," Morgan Stanley; and Resonanz Capital research on portfolio rebalancing (August 2025). ↩︎

3. Data ownership structure from Simply Wall St

4. Image Attribution and Disclaimer: Images featuring people in this publication are synthetically generated using artificial intelligence and are used for illustrative purposes only. These images do not represent real individuals. Any perceived resemblance to actual persons, whether living or deceased, is entirely coincidental and unintentional. No identification with, or endorsement by, any actual person is intended or should be inferred.

5. Disclosure: Glavcot Insights and its contributors may hold positions in securities discussed in this article. All content is provided for informational and educational purposes only. This is not investment advice—readers should perform independent research and consult financial professionals before making investment decisions.

Glavcot Insights is now live. Join the free tier to get new research, updates, and future analysis directly in your inbox. (Check your spam folder if you don't see the confirmation email)