Grab Holdings: Snapshot

Grab Holdings Limited

First Principles Brief (GRAB)

"Engineering an Economic Flywheel."

The One-Liner

Southeast Asia's leading "super-app," utilizing a massive delivery network to build out financial services across the region.

The "Fragmented Reality"

Southeast Asia was a mess of unreliable services. Sketchy taxis and inconsistent delivery created high friction for millions.

The Solution

"Digital Middleman"

The Flywheel Effect

Hook users with rides, profit from Finance.

Scale (Low Margin)

Build massive user base via Rides & Food.

Monetize (High Margin)

Cross-sell Loans, Payments & Insurance.

Cash Flow Surge

Net Profit Margin

3.6%

FCF Margin (LTM)

21.2%

Verdict: Profits are real.

%

Cost Discipline

Overhead Costs: Plummeted

The Shift

From "Growth at all costs" to "Profitable Growth." Overhead fell from 116% to 27%.

The Owner's Dilemma

A "show-me" story. You aren't buying what Grab is today, but what it's becoming.

The Risk

Execution & Competition.

The Bet

Regional Dominance.

Verdict

High-Risk, High-Reward

"A recovering patient showing strong vital signs. A potential home run if the trajectory holds."

Based on Glavcot Insights: "First Principles Brief"

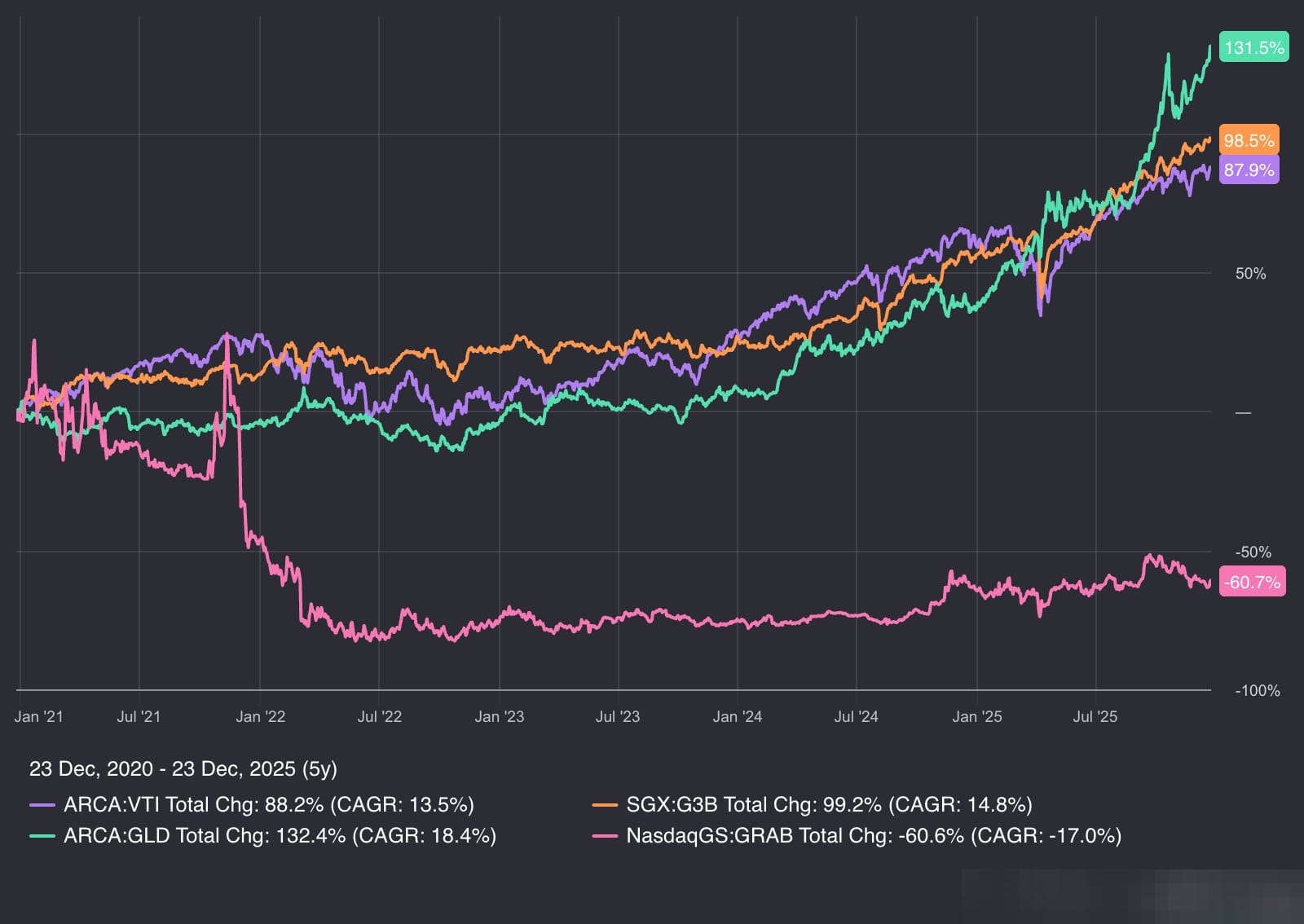

Historical Performance Context

Comparison shows total return as if one invested in the S&P 500 index, the Singapore STI, and gold over the displayed period. Past performance is not indicative of future performance.

Grab Holdings Ltd (GRAB) | First Principles Brief

Grab is Southeast Asia’s leading “super-app,” using its massive ride-hailing and delivery network to build out financial services and business solutions across the region.

The chart shows historical context only. Share price performance reflects both business fundamentals and market sentiment over time. We include it to show how past long-term shareholders were rewarded, not to predict future returns. Investment decisions should be based on current business quality and forward outlook.

Disclosure: Glavcot Insights and its contributors may hold positions in securities discussed in this article. All content is provided for informational and educational purposes only. This is not investment advice—readers should perform independent research and consult financial professionals before making investment decisions.

As of the date of publishing, business conditions may have changed since publication. Verify current information through official company sources.

Disclosure: Glavcot Insights and its contributors may hold positions in securities discussed in this article. All content is provided for informational and educational purposes only. This is not investment advice—readers should perform independent research and consult financial professionals before making investment decisions.

As of the date of publishing, business conditions may have changed since publication. Verify current information through official company sources.

Where Clarity Meets Conviction

Glavcot Insights is now live. Join the free tier to get new research, updates, and future analysis directly in your inbox. (Check your spam folder if you don't see the confirmation email)