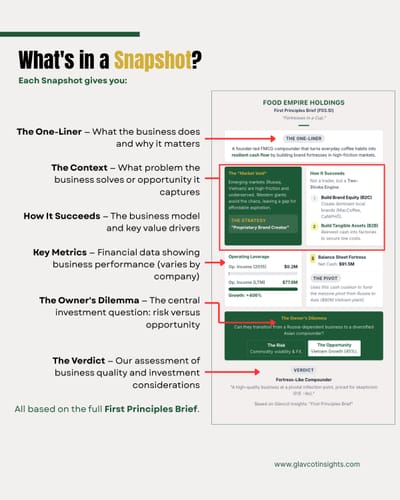

Food Empire: Snapshot

Food Empire Holdings

First Principles Brief (F03.SI)

"Fortresses in a Cup."

The One-Liner

A founder-led FMCG compounder that turns everyday coffee habits into resilient cash flow by building brand fortresses in high-friction markets.

The "Market Void"

Emerging markets (Russia, Vietnam) are high-friction and underserved. Western giants avoid the chaos, leaving a gap for affordable aspiration.

The Strategy

"Proprietary Brand Creator"

How It Succeeds

Not a trader, but a Two-Stroke Engine.

Build Brand Equity (B2C)

Create dominant local brands (MacCoffee, CaféPHỐ).

Build Tangible Assets (B2B)

Reinvest cash into factories to secure low costs.

Operating Leverage

Op. Income (2015)

$0.2M

Op. Income (LTM)

$77.6M

Growth: +406%

$

Balance Sheet Fortress

Net Cash: $91.5M

The Pivot

Uses this cash cushion to fund the massive pivot from Russia to Asia ($80M Vietnam plant).

The Owner's Dilemma

Can they transition from a Russia-dependent business to a diversified Asian compounder?

The Risk

Commodity volatility & FX.

The Opportunity

Vietnam Growth (45%).

Verdict

Fortress-Like Compounder

"A high-quality business at a pivotal inflection point, priced for skepticism (P/E ~8x)."

Based on Glavcot Insights: "First Principles Brief"

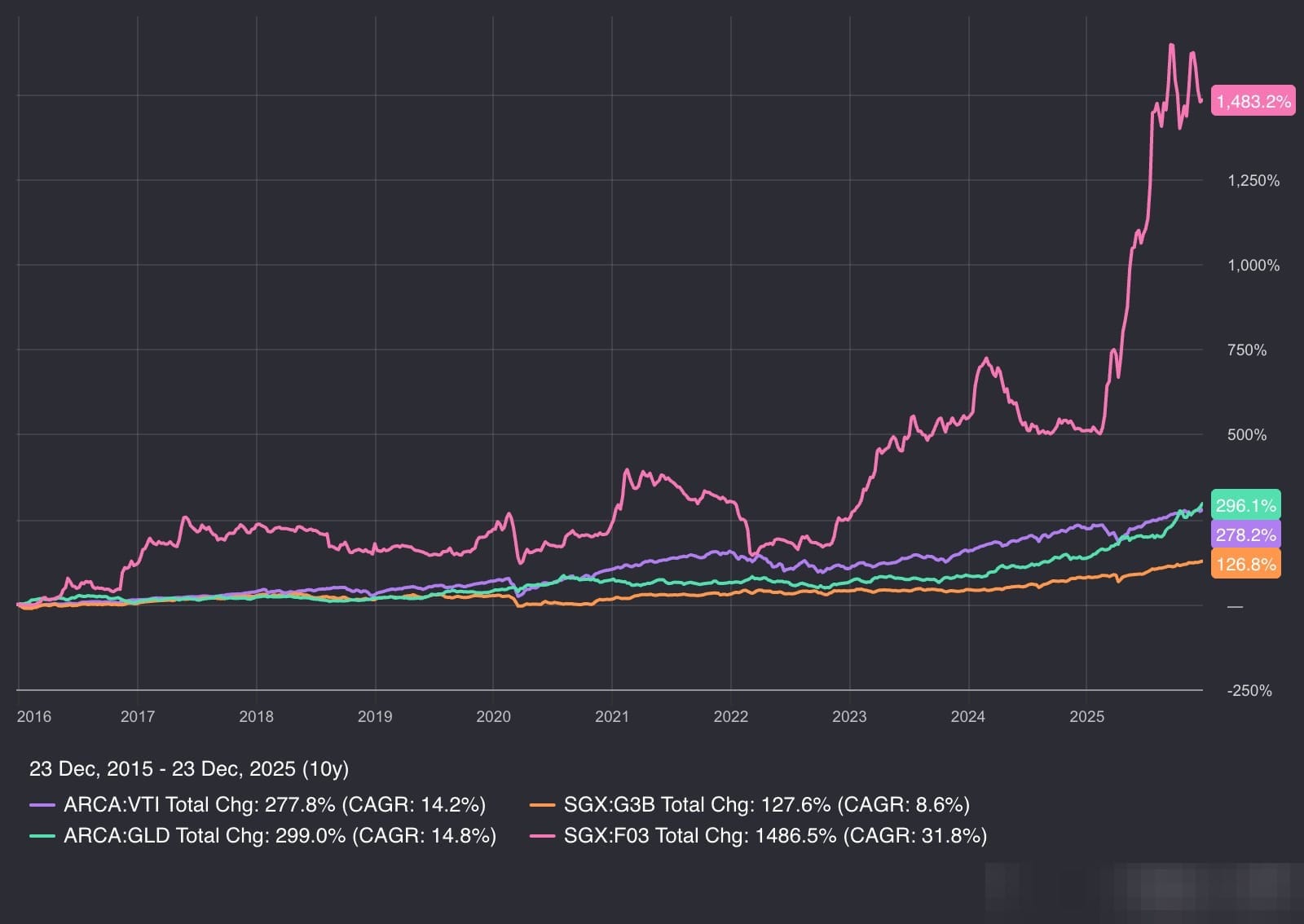

Historical Performance Context

Comparison shows total return as if one invested in the S&P 500 index, the Singapore STI, and Gold over the displayed period. Past performance is not indicative of future performance.

Food Empire Holdings (F03) | First Principles Brief

Food Empire turns everyday coffee habits into long-term compounding — earning in U.S. dollars, operating debt-free, and quietly diversifying its geopolitical risk by replicating its proven fortress-building playbook from Eastern Europe to high-growth Asia.

The chart shows historical context only. Share price performance reflects both business fundamentals and market sentiment over time. We include it to show how past long-term shareholders were rewarded, not to predict future returns. Investment decisions should be based on current business quality and forward outlook.

Disclosure: Glavcot Insights and its contributors may hold positions in securities discussed in this article. All content is provided for informational and educational purposes only. This is not investment advice—readers should perform independent research and consult financial professionals before making investment decisions.

As of the date of publishing, business conditions may have changed since publication. Verify current information through official company sources.

Disclosure: Glavcot Insights and its contributors may hold positions in securities discussed in this article. All content is provided for informational and educational purposes only. This is not investment advice—readers should perform independent research and consult financial professionals before making investment decisions.

As of the date of publishing, business conditions may have changed since publication. Verify current information through official company sources.

Where Clarity Meets Conviction

Glavcot Insights is now live. Join the free tier to get new research, updates, and future analysis directly in your inbox. (Check your spam folder if you don't see the confirmation email)